Facts Piece #56C: Incentives underneath the Fair Labor Criteria Operate FLSA You S. Department away from Work

Posts

- Heavens Force provides airmen merely months to reenlist to possess maintenance bonus

- Complete Experience in 5 X Pay Position

- MORE: RFK Jr. unveils want to phase aside 8 fake eating dyes in the All of us

- Q26. From the what stage of development, design, otherwise operations is plans entitled to optional pay? (extra June 14,

If you’lso are fulfilling a branch otherwise party to possess finding certain wants, separate the full extra count from the amount of team eligible on the extra. There are many kind of incentive shell out teams can use to reward group to have a career well written, and also the extra calculation may differ by the type. On the businesses directors, compensation to have Jonathan Mariner is actually 279,998, to own Matthew Rizik are dos.510 million, for Suzanne Shank are 279,998 as well as Nancy Tellem is 291,998. Government chairman Dan Gilbert and his awesome spouse, Jennifer, did not receive any registered settlement regarding the statement from charge, cash or inventory prizes. Under arrangements revealed Saturday, Household Equipped Features Panel participants next week often think language inside the its yearly shelter authorization statement draft complete with highly modified military spend tables built to give all the junior enlisted shell out to help you from the least 29,100 annually. “Which features a great misalignment inside extra standards anywhere between employers and you may personnel,” said the fresh questionnaire statement.

Heavens Force provides airmen merely months to reenlist to possess maintenance bonus

In the 1,400 billable days that have 90percent collection, the new sum margin created by a 50,one hundred thousand annually personnel is actually 53,400 (once deducting the fresh ten,100000 fringe benefit). For each and every additional 100 times of billed go out (at the 90percent collection) produces 8,100 away from progressive margin. In the end, spread the main benefit percentage to the worker otherwise team members according for the company’s founded tips. Including handling the benefit as a result of payroll, giving an alternative added bonus take a look at, otherwise organizing for electronic financing import. Ultimately, since the FLSA regulates nothing in the form of actual salary repayments, write-offs, and you may notice out of shell out terms, of many states has outlined conditions and may also even have other provisions to possess low-exempt rather than excused staff.

Complete Experience in 5 X Pay Position

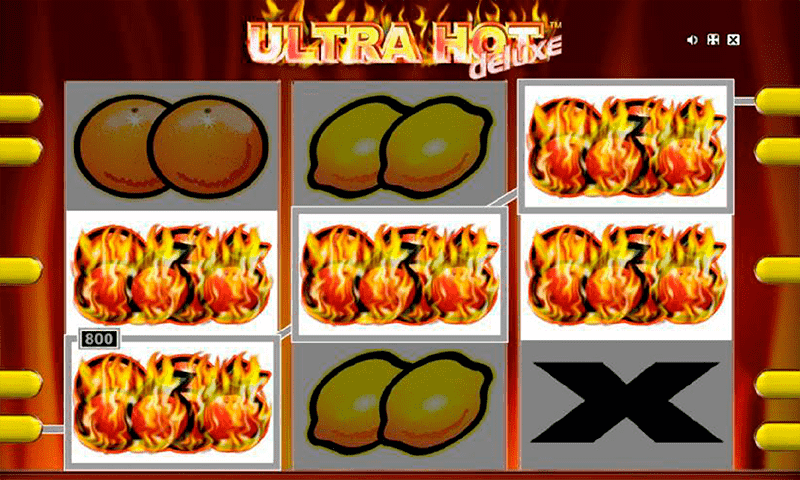

There is a large signal over the reels however the chief town is employed to your harbors 3 reels and you may pay dining table. Addititionally there is an excellent ‘wild’ icon for this slot, that’s represented by “five times Shell out” online game symbolization. That it icon constitutes while the one and only unique function out of this game. Five times Spend was created to your experienced slot people inside notice who relish constant smaller pays when you’re troubled to the big payouts. From greeting bundles in order to reload incentives and more, find out what bonuses you can purchase in the our very own finest online casinos.

A long list of claiming this type of around three income tax loans is provided in the the past legislation. A good. Optional spend is available once an enthusiastic applicable borrowing try earned and able to become stated for the associated yearly income tax come back. In general, an income tax borrowing from the bank try attained within the nonexempt year the newest appropriate borrowing from the bank home is placed in solution (money tax credits) otherwise eligible design happens (creation income tax credits).

The new suggestion needs an extra cuatro,100000 deduction becoming offered to grownups ages 65 as well as over, whether or not they take the fundamental deduction happy-gambler.com have a glimpse at this link or itemize their efficiency. The fresh deduction perform begin to stage out to possess solitary filers with over 75,100 inside the altered modified gross income, as well as for married couples who document as you along with 150,100. The alteration, titled an excellent “bonus” in the laws and regulations, aims at providing retirees continue more cash within purse and will be offering an alternative to the very thought of getting rid of taxes for the Social Protection advantages, and that Chairman Donald Trump and several lawmakers has touted. Keep your favorite games, explore VSO Gold coins, sign up competitions, score the brand new incentives, and a lot more. The fresh bluish seven rewards fifty, 100, or 150 loans, because the red one to pays 60, 120, or 180. The problem is entirely some other to your better paytable icon where Five times Spend symbol stands out.

The fresh payment bundle of your outgoing Chief executive officer out of Skyrocket Organizations Inc. enhanced inside 2022 almost 5 times the worth of just what the guy obtained the entire year earlier, in spite of the Detroit-dependent home loan giant’s funds falling 88percent just last year. ten of those occasions have been spent some time working in the an apartment-price that has been determined when planning on taking 12.7 times. Unique functions airmen are nevertheless within the high demand, from pararescuemen to combat controllers, in addition to volatile ordnance fingertips teams. Air Force is once again offering early community commandos five times its ft shell out, and you can a little reduced to possess special providers ranging from six and you will twenty years out of service.

Overtime earnings – Currently treated such as regular wages, overtime wages is subject to state and federal income taxes, Public Protection and you may Medicare withholding. The new Tax Foundation and Yale’s Funds Research utilized in April you to definitely federal cash will be shorter by 680-866 billion out of 2025 in order to 2034 if overtime pay wasn’t taxed. The newest vintage reel part, and money roll effects is actually an enticing voice on the severe athlete.

MORE: RFK Jr. unveils want to phase aside 8 fake eating dyes in the All of us

5 times Pay is a great video game to possess professionals whom have fun with Mac otherwise Linux possibilities as you will maybe not encounter being compatible problems amongst the application of one’s gambling enterprise plus the os’s of your computer. The newest currencies in which you can place real money bets for the the five Minutes Shell out slot machine game are the Us Buck, british Pound as well as the Euro. Indicated another way, an average practitioner otherwise small firm bills and you may gathers the common away from around twice salary and you can edge advantages per year per professional worker. Out-of-pouch breakeven is roughly step one.twice feet income (because of perimeter pros) or 667 fundamental occasions—on the sixty,100 annually to own an excellent 50,000 a-year staff. Sooner or later, figuring bonus spend is not just regarding the numbers; it’s on the taking and you may satisfying staff because of their effort, work, and you can benefits to your popularity of the company.

Inside the a strict work industry, a spot extra will be supplied to maintain key personnel (this type of added bonus is more especially entitled a good maintenance added bonus). For personnel, someplace added bonus is going to be a pleasant surprise, as well as a settlement strategy to keep in mind for additional compensation within the-ranging from improve cycles otherwise if there is an income frost. “Call-back” shell out is more compensation paid off so you can a member of staff to have addressing a visit from the workplace to execute additional functions which had been unexpected by company.

Over fifty percent of your personnel taking part in the newest questionnaire or 57 per cent imagine they’ll discovered one to amount. The fresh label allotted to the bonus and also the cause for the fresh bonus do not conclusively determine whether the benefit are discretionary. When you are a plus is generally labeled discretionary, whether it does not adhere to the brand new terms of one’s statute, then the incentive isn’t an enthusiastic excludable discretionary incentive. The brand new dedication should be generated for the an instance-by-case foundation depending on the certain items. Find out how Marsh McLennan properly speeds up group well-being that have digital products, boosting output and you can work satisfaction for over 20,100 personnel.

Home Equipped Functions Panel management features vowed to drive to your army paycheck grows, and will choose to your measure in a few days. Home appropriators recognized similar preparations in their finances debts this past year and now have signaled ongoing service to your idea. To make certain Elizabeth-4s aren’t delivering repaid more than E-5s, the new shell out desk overhaul also incorporates expands to own mid-community signed up troops. Combined with 4.5percent across-the-panel raise, specific Age-5s could see around a good several.5percent pay improve the following year. To have an elizabeth-dos that have 2 yrs away from military services, one improve will mean on the 5,one hundred thousand in the more shell out next year.

Q26. From the what stage of development, design, otherwise operations is plans entitled to optional pay? (extra June 14,

Beneath the suggested legislation, merely communities that will be exempt out of tax from the area 501(a) is income tax-exempt teams eligible for elective pay. In general, the newest Agency of one’s Treasury (Treasury Service) and the Internal revenue service (IRS) do not offer personalized tax suggestions from whether or not a particular business’s enterprise or interest is approved to have a tax borrowing from the bank. To learn more in the clean opportunity taxation credit, excite come across Credits and deductions beneath the Rising cost of living Prevention Operate of 2022. This particular fact layer will bring standard factual statements about the typical rate away from pay underneath the FLSA. That it identifies extra pay money for days labored on vacations otherwise weekends, that may are different based on the company and you may collective bargaining arrangement.